Resale may be a hot sector at the moment, but that doesn’t mean it’s an easy business to be in, especially when it comes to making money. Selling used goods is time-intensive and involves reverse logistics processes and single-SKU assortments that the typical retailer doesn’t have to deal with, all of which can be a drag on the bottom line.

Because GoodBuy Gear is a resale marketplace for used baby and kids’ products, however, CEO and Co-founder Kristin Langenfeld counts herself lucky: “Everyone’s trying to crack this nut because we can’t go on as a society with single-use everything,” she said in an interview with Retail TouchPoints. “We have to be able to have a circular economy, but making the math work is really hard. We have a huge advantage because baby gear is expensive and it doesn’t last long, so our buyers become sellers. We can make the math work where in [categories like] clothing it’s harder.”

But the site’s success isn’t based solely on its category; Langenfeld also credits tech and logistics innovations for helping make her resale business viable. Over the past eight years, Langenfeld and her team have built a robust process for the receipt, inspection and listing of used baby gear (a product for which consumers tend to be more discerning than normal given that it involves their kids’ safety).

Most recently AI also has entered the mix, and the results have been undeniable. By implementing the AI-powered photo editing solution Photoroom into its arsenal, GoodBuy Gear has been able to improve the employee experience while also increasing conversion rates. “All this AI and new technology is just moving the ball forward and helps make the math work faster,” said Langenfeld.

Advertisement

Nurturing Parent Trust

Any parent will tell you that kids come with a lot of stuff. Not only that, but all that stuff rapidly becomes obsolete because kids grow — fast.

Langenfeld previously worked in tech, but she didn’t understand her sister-in-law’s appeals to build a better way to sell and buy baby gear until she had kids of her own. GoodBuy Gear started first in a parents’ group on Facebook that Langenfeld was part of and grew from there into the standalone marketplace it is today.

The marketplace isn’t peer-to-peer, which is one of its strengths, because one the biggest barriers to resale in this category is that parents need to trust that the used product they’re buying is still safe for their child. To address that issue, GoodBuy Gear processes, inspects and lists all items on the marketplace itself in four facilities across the U.S.

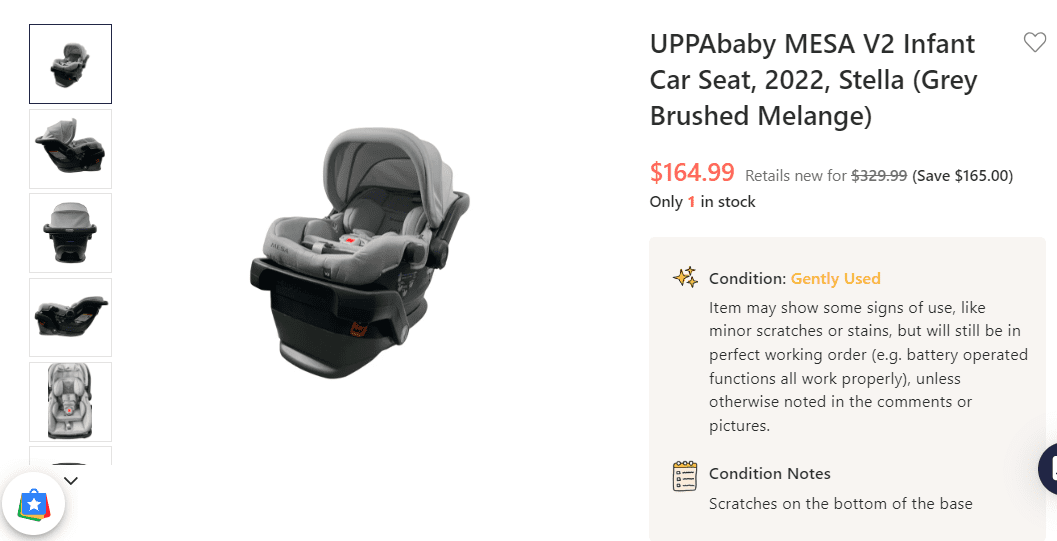

“Our biggest differentiator is our commitment to quality and inspection and safety,” explained Langenfeld. “We are the only one of any of our competitors, for example, that touch car seats. It took many years to get that off the ground; we partnered with folks from the NHTSA (National Highway Traffic Safety Administration, CPSTs [Consumer Product Safety Technicians] and all those acronyms on the safety side of the industry. We’re trying to elevate the entire market versus disrupting it, and so that’s really been the key to our success.

“Most of these products are built to withstand the apocalypse, so brands know that they’re going to other families, but how do you ensure that their brand is upheld in that secondhand market and make sure that it’s safe and functioning as intended?” Langenfeld added. “We really partner with them to make sure that they can not only be part of the financial side of [this secondhand market], but more importantly, that this new group of consumers are able to experience their products at a lower price.”

This commitment to safety and quality actually led GoodBuy Gear to one of its biggest unlocks. In addition to goods from consumers, GoodBuy Gear now accepts and resells products that brands and retailers can no longer sell, either due to cosmetic flaws or because they were returned.

The company isn’t able to share the names of most of the retailers it works with due to confidentiality agreements, but more than 50 brands have joined its Green Gear Coalition to support resale, including Stokke, Bugaboo and Thule.

A Small Change with Big Results

To ensure parents have confidence in shopping used, GoodBuy Gear inspects every item before it’s listed — whether it comes from a retailer, manufacturer or consumer — and even has developed a database (referred to internally as the Blue Book of Baby Gear) to simplify the process of creating product listings. There was one hang up though: the product images.

The company’s marketing team knew that better product images would help enhance customers’ confidence in their purchase and lead to better conversion rates. But after trying “a million things on the operations side,” such as better backdrops and lighting, the improvements weren’t substantive. So the team turned to tech — specifically the Photoroom image editing app.

Photoroom is available for anyone to use; in fact, the app has been downloaded 150 million times around the world. But enterprise customers with more sophisticated needs can process images at scale through the app’s subscription-based API, and that’s what GoodBuy Gear has done. Photoroom is now integrated into the site’s workflow, so “somebody takes an image, runs it through the Photoroom API where it gets cleaned up, and then we have beautiful images on our site” that can be processed in large batches, said Langenfeld.

Most brands will do some kind of moderation of the AI-edited images to double-check that they meet company standards, but it’s not necessary, said Michelle Belcic, Head of B2B Sales and Partnerships at Photoroom in an interview with Retail TouchPoints.

This year, GoodBuy Gear will take an estimated 350,000 photos for its website. Now, with Photoroom, employees touch approximately 56% less photo listings than they did before, which has saved as much as 80 hours of work a week.

“It also helps from a physical build-out standpoint because we don’t have to have beautiful [photo] stations,” added Langenfeld. “We have lighting, but the stations don’t need to have pristine white floors and white walls.”

Removing backgrounds is the application’s “bread and butter,” according to Belcic, but Photoroom also can perform more sophisticated editing tasks, like adding drop shadows, generating new backgrounds, expanding backgrounds to modify the size of an image for different platforms and even adding elements to a photo, such as a lamp in an image of a room — all through the power of generative AI.

“The capabilities are broad, but the idea is to multiply what you can do with assets or photos you have, whether it’s for marketing, media, ads, etcetera,” said Belcic. “Our go-to-market strategy is to make it easy for people. We’re here if you have questions, but there are so many people who just come and get a subscription and integrate it directly into their tech.”

To date, GoodBuy Gear has sold more than 20,000 items that featured Photoroom imagery, and seen notable increases in both conversion rate and orders.

“With a marketplace that is so inventory-driven like ours, it’s hard to associate [shifts in performance] to just one change, but I think the overall increase in conversion rate over time is definitely due in large part to Photoroom,” said Langenfeld.

Assuaging AI Fears

Belcic said that one of the most frequent questions she’s asked by Photoroom’s enterprise customers is whether the AI will change the look of the product itself. The answer, according to Belcic, is “absolutely not. Our customers are ecommerce operators, resellers, marketplaces — if [Photoroom] edited the actual product then that would completely break that bond of trust with the consumer. You can change everything around it, but your product’s going to stay the same. [On GoodBuy Gear] you can zoom in and see the dents and dings because they are open-box or reused items, but it’s important for consumers to know that it’s not a stock image.”

Belcic also is frequently asked what Photoroom’s AI model is trained on. The app has contracts with a number of stock image sites and photographers specifically for training its AI model, so “you’ll never be able to create a copyrighted image,” explained Belcic. “And you won’t have issues with nudity or violence, because we never showed those to our model. Then once you create the image, that’s your image, it belongs to you, and you can use it how you want.” Customers can opt in to allow Photoroom to train on their images to further improve the model, but that’s their choice. And for customers using Photoroom via the API, those images are never seen or stored by the Photoroom corporate entity, so it’s not even a question.

For Langenfeld, the biggest test of any tech is the way the agreement is structured. “I just hate companies that are like, ‘Buy our product for 12 months and we promise it’ll work,’ as opposed to being like, ‘Let us give you the ability to use it and our product will speak for itself,’” she said. “Photoroom is an example of [the latter].”

The results at GoodBuy Gear certainly speak volumes, and Belcic said they also address one of the biggest fears about AI: “It’s normal to question whether AI is going to come for your job,” she said. “But what we’ve seen is it takes away the repetitive tasks and allows employees to focus on things that require more thought. Take the case of GoodBuy Gear, having somebody sit there and remove backgrounds manually one at a time — nobody really wants that job. In any case, AI doesn’t run by itself. A human still has to tell the AI what to do. Rather than taking away jobs it’s allowing people to do things that require more creativity and human input.”